Streamline Your Workflow With TTS Tax Software's

User-Friendly Interface & Advanced Functionality

Error Checking

Automatically preform error checks and calculations in real-time, ensuring accurate and error-free tax returns every time.

e-Signature

No sign pad required, remote signature options are available to complete all tax related signature forms including bank documents.

Forms & Schedules

Access over 2,000 federal and state tax forms, schedules, worksheets, and more, all in one place in our form library.

Cloud-Based

Our cloud-based software lets you prepare and file tax returns from any device, ensuring flexibility and convenience for you and your clients.

Bank Products

A hassle-free payment solution with low-cost options to meet the needs of both you and your client.

K-1 Import

Quickly and easily import K-1 information into your individual tax return! This saves valuable time and reduces the risk of manual data entry errors, ensuring efficiency and accuracy.

Customizable Reports

Our built-in reporting tools allow you to generate custom reports for your clients, providing detailed insights into their tax returns.

Quick Estimator

It’s perfect for both in-person and remote consultations. You can save the quick estimate for later or begin the tax return directly from the information entered in the estimator.

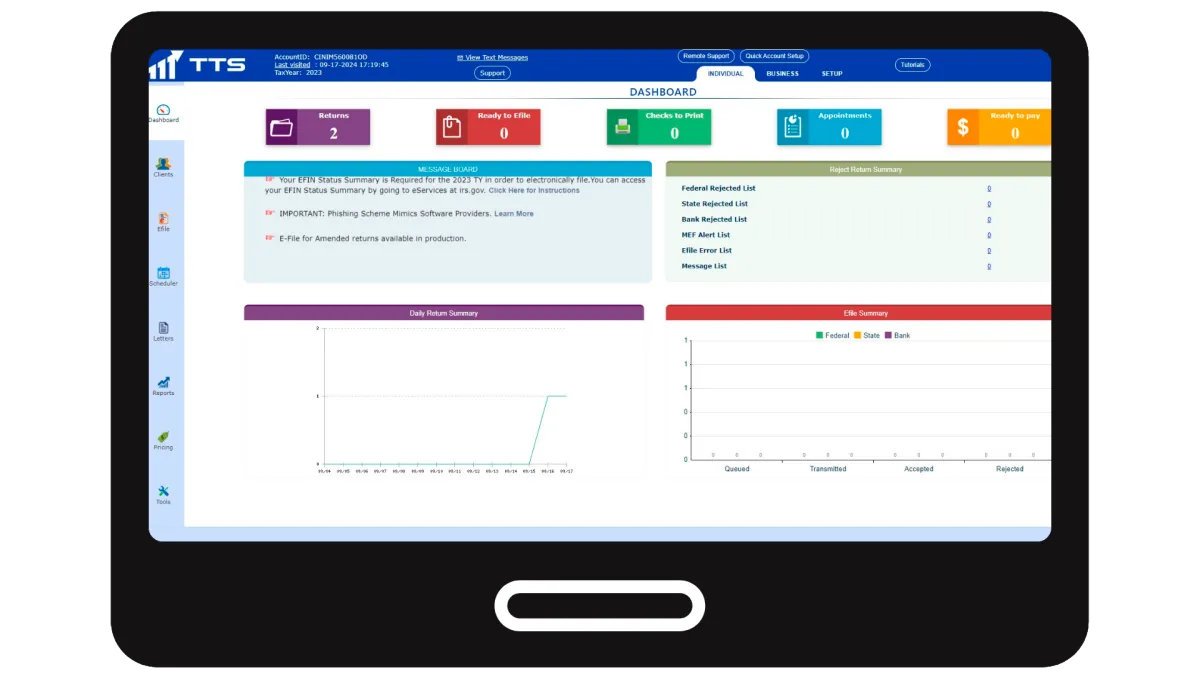

Prepare And File Anywhere, Anytime

Cloud-Based Tax Preparation Software

Our cloud-based software allows you to prepare and file tax returns from any device, providing flexibility and convenience to both you and your customer.

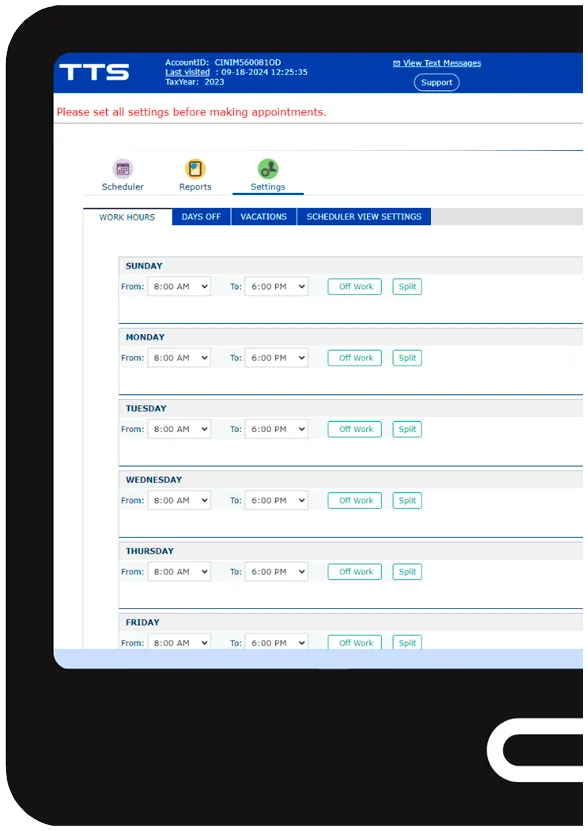

You will be able to schedule your appointments with clients within the same tax software.

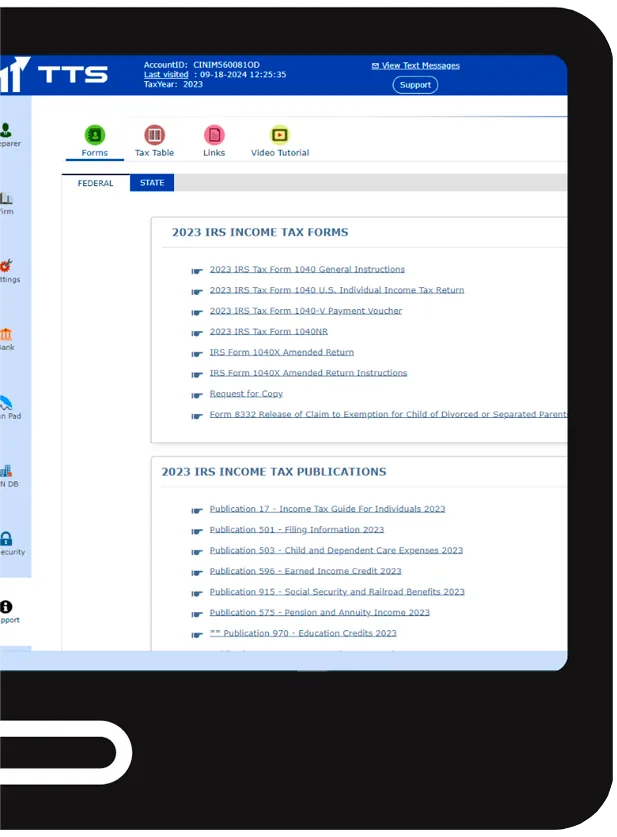

Easy Form Access

Extensive Tax Form Database

Access over 2,000 federal, state and local tax forms, schedules, worksheets, and more, all in one place within our form library.

The database is updated, and you can filter your search results to include only official websites, ensuring that you receive quick, accurate, and reliable information.

Software Features

Unlimited Users

Free Data Conversion

Unlimited forms: 1040, 1040-NR, 1040-SS Returns

Unlimited forms: 1120, 1120-S, 1120-H, 1065, 1041 Returns

Unlimited Federal e-File

Unlimited State programs

Document Manager w/ PDF Printer

Onboarding - Getting Started Webinar

Customer Support (phone and email)

Tax Compliance

🗹 Over 4,300 federal, state and local forms and schedules

🗹 Hundreds of return diagnostics to help ensure accuracy

🗹 Comprehensive Tax Planner

🗹 Part-Year and Non-Resident State Returns

🗹 Print key forms in Spanish

🗹 Filing Status Optimization

🗹 Detailed Fixed Asset Reports

🗹 Form 114 FinCEN (E-file)

🗹 Includes Forms 5471, 4720, 3115, and 1118

🗹 Import 4562 assets, 8948 transactions, and trial balances

🗹 Export K-1s from pass-through entities to individual returns

🗹 City/Local Programs for all states

🗹 Multi-Year Comparison Report

🗹 Prior year programs available for 2022, 2021, 2020, 2019, 2018

Integrations

🗹 Bank Products / Pay with Refund Options

🗹 Audit Assistance and ID Theft Restoration *

🗹 E-Sign

🗹 Tax Forms Book

🗹 Accept Credit, Debit, and Contactless Payments

Workflow Features

🗹 Client Status Manager

🗹 Scheduler

🗹 Pre-Season Letters and Organizers

🗹 Autofill provider data form EIN database

🗹 DoubleCheck - Intuitive review and verify system

🗹 LookBack - Compare to prior year from entry

🗹 LinkBacks - Quick link from diagnostic to source

🗹 Client presentation

Office Management

🗹 Network-ready

🗹 Multi-firm support

🗹 Backup / Restore

🗹 Office Configurations

🗹 Tax Preparer Configurations

🗹 Multi-factor Authentication

PRICING

Choose Your Plan

ONE-TIME PAYMENT

$1,499

$897

2 PAYMENTS

$799/m

$499/m

3 PAYMENTS

$549.99/m

$349/m

Effortless Tax Solutions for a Hassle-Free Experience for Tax Pros

Links

Home

Pricing

Contact Us

Curso Preparador de Impuestos

Terms

Copyright Technology Tax Solutions 2026